Office Rental Rates in NY- Year End 2013

Office Rental Rates in NY- Year End 2013

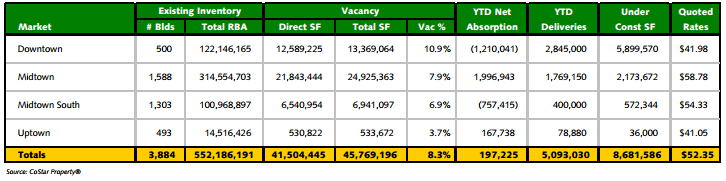

Its a big city! At the close of 2013 total office inventory in New York City amounted to 552,186,191 square feet in 3,884 buildings. But how were these spaces priced? According to Costar Group, Inc., city-wide rental rates continue to trend upward and averaged $52.35 PSF, an increase of 1.8% over $51.44 in Q3. This is a result of improving economic conditions and robust demand by the media and tech sectors in particular.

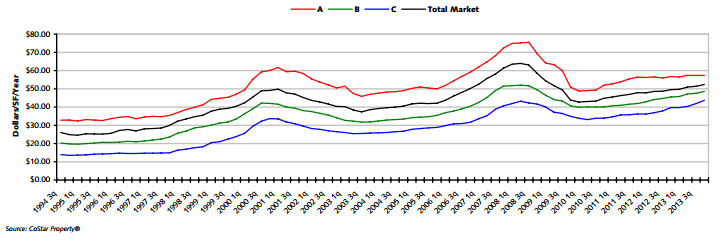

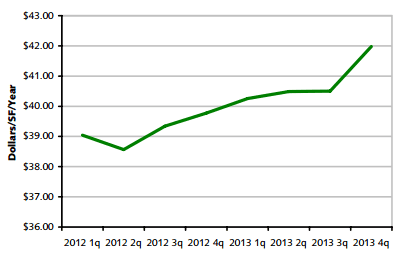

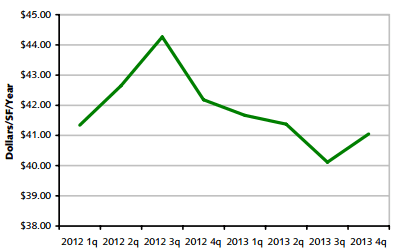

For a more detailed look at HISTORICAL RENTS in Class A, B and C buildings examine the graph below. It shows year end average rental rates to be:

Class A @ $57.40 PSF

Class B @ $48.62 PSF

Class C @ $43.68 PSF.

SUB-MARKET STATISTICS:

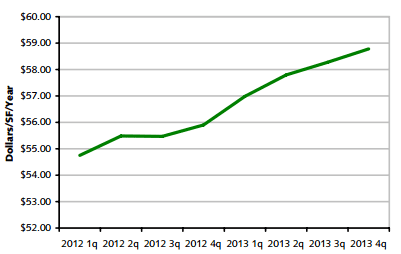

Midtown: Grand Central, Plaza District, Columbus Circle, Times Square, Penn Station/Garment Center, Murray Hill and United Nations Plaza.

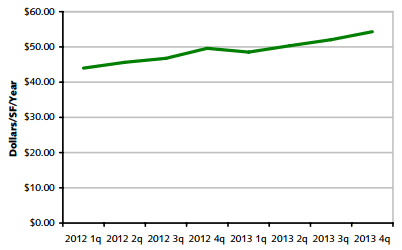

Midtown South: Gramercy Park, Chelsea, Hudson Square, Greenwich Village and SOHO,

Downtown: Financial District, Insurance District, City Hall, Tribeca and the World Trade Centers

Uptown: Upper East Side, Upper West Side and Harlem/North Manhattan.

HISTORICAL ANALYSIS OF QUOTED RENTAL RATES- Class A, B & C Buildings:

BEST STRATEGY FOR LEASING AN OFFICE IN NYC

Building Agents (the Landlord’s Leasing Agent) are under contract with a building owner to lease space at the highest rents obtainable. Companies that negotiate directly with a Landlord or its Building Agent are at a disadvantage because they are unaware of: (1) all of the available spaces and the pricing in comparable properties; (2) the economic terms of recently signed leases; and (3) local market practices that impact lease costs including Tenant Improvement Packages (cash contributions provided for construction/renovation or build-to-suit programs), Rent Abatement incentives, Operating and Real Estate Tax Escalations, Security requirements, etc. By using an experienced TENANT REPRESENTATION BROKER you can secure the optimal NYC office space and lease terms. Cogent Realty Advisors is a NO FEE Tenant Representation Broker with over 15 years of success. Contact Mitchell Waldman today: (212) 509-4049.